Fidelity Alternative for Investors nyt

In the realm of investment management, Fidelity has long been regarded as a stalwart, offering a broad array of investment options and services. However, as the financial landscape evolves and investor preferences shift, exploring alternative platforms and strategies has become a prudent approach for many seeking to diversify and optimize their portfolios.

While Fidelity Alternative for Investors nyt offerings are extensive and reputable, there’s an increasing interest among investors to explore alternatives that may better align with their specific goals, risk tolerance, and preferences. Here, we delve into some alternative platforms and avenues that investors are considering in today’s dynamic market.

1. Vanguard:

Vanguard stands out as a robust alternative to Fidelity. Renowned for its low-cost index funds and ETFs, Vanguard has attracted investors looking for cost-efficient yet diversified investment options. Its commitment to investor-owned structure and emphasis on long-term investment strategies resonates with those seeking stability and steady growth.

2. Charles Schwab:

Charles Schwab offers a comprehensive suite of investment services, combining low-cost ETFs with a user-friendly interface. Its robo-advisors cater to investors seeking automated portfolio management while providing access to a wide range of investment choices and financial planning tools.

3. Robinhood:

For the tech-savvy and cost-conscious investor, Robinhood offers commission-free trading on stocks, ETFs, options, and cryptocurrencies. Its intuitive mobile app and fractional shares feature have attracted a younger demographic eager to start investing with minimal barriers.

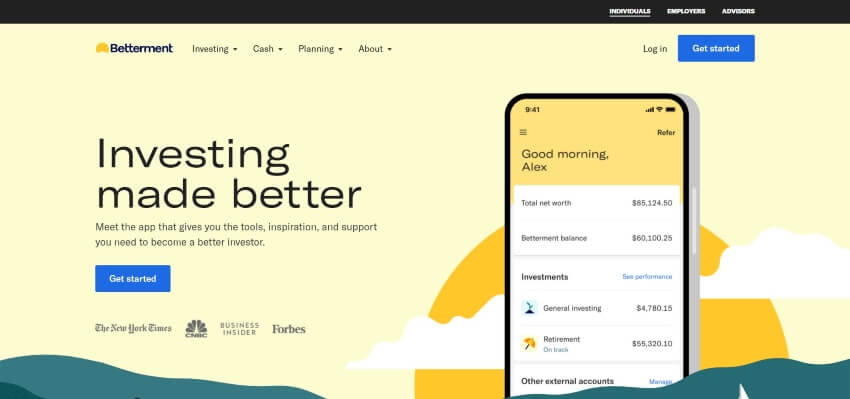

4. Wealthfront and Betterment:

Robo-advisors like Wealthfront and Betterment employ algorithms to build and manage diversified portfolios tailored to individual risk tolerances and financial goals. These platforms offer automated investing and rebalancing, making them appealing options for hands-off investors.

5. Real Estate and Alternative Assets:

Diversification isn’t limited to different investment platforms; it extends to various asset classes. Investors increasingly consider real estate crowdfunding platforms like Fundrise or alternative assets such as precious metals, cryptocurrencies, or peer-to-peer lending platforms to complement their traditional investment portfolios.

Conclusion:

While Fidelity Alternative for Investors nyt remains a robust and reputable investment platform, exploring alternatives can offer diversification, different investment philosophies, and a wider range of options to suit individual investor needs. Choosing the right platform often involves assessing one’s risk tolerance, investment goals, and desired level of involvement in managing the portfolio.

Ultimately, the best approach may be a hybrid one—leveraging the strengths of multiple platforms or combining traditional and alternative investments to create a well-rounded and diversified portfolio. Regularly reviewing and adjusting one’s investment strategy in line with changing market conditions and personal circumstances remains crucial for long-term financial success.

The investment landscape continues to evolve, presenting investors with a multitude of choices beyond Fidelity Alternative for Investors nyt. Exploring these alternatives empowers individuals to make informed decisions and construct portfolios that reflect their unique financial aspirations and risk profiles.